A good CIBIL score is essential to get loans, credit cards, or better financial opportunities. If your CIBIL score is 500, you may struggle to get loan approval. However, if you’re wondering How to Increase CIBIL Score Form 500 to 750, there are strategic steps you can take to improve your creditworthiness. By managing your credit utilization, making timely payments, and maintaining a healthy credit mix, you can steadily boost your score.

This guide will help you understand how your CIBIL score works and provide actionable steps to improve it from 500 to 750+ effectively.

What is a CIBIL Score?

A CIBIL score is a three-digit number ranging from 300 to 900 that reflects your credit history and financial discipline. A higher score increases the chance of getting approved for a loan with a better interest rate.

CIBIL Score Range & Meaning

| CIBIL Score | Creditworthiness | Loan Approval Chances |

| 750+ | Excellent | High |

| 650-750 | Good | Moderate |

| 550-650 | Poor | Low |

| Below 550 | Very Poor | Very Low |

If your CIBIL Score is 500, you need to take immediate steps to improve it.

How to Increase CIBIL Score form 500 to 750?

1. Pay EMIs and Credit Card Bills On Time

Late Payments negatively affect you credit score. to improve your score:

Set reminders for EMI due dates. Enable auto-pay to avoid missing payments. pay the full amount instead of the minimum due.

2. Reduce Credit Utilization

Using more than 30% of your credit limit lowers your score. Example: If your credit card limit is ₹1,00,000, try not to spend more than ₹30,000. Request for a higher credit limit but maintain low usage.

3. Avoid Multiple Loan Applications

Applying for multiple loans in a short period makes you look credit hungry. Apply for new credit only when necessary. Maintain a good repayment history before seeking new loans.

4. Check Your CIBIL Report For Errors

Errors in your credit report can reduce your score. Regularly check your CIBIL report for mistakes. If you find any errors, report them to CIBIL immediately.

5. Opt for a Secured Loan or Credit Card

If you have a low credit score, getting an unsecured loan is difficult. Apply for a secured credit card agains an FD (Fixed Deposit). Take a secured loan and make timely payments.

6. Maintain a Long Credit History

Old credit accounts improve your credit history, increasing your score. Do not close old credit cards, even if you don’t use them frequently. Keep accounts active by making small transactions.

7. Use a Credit Builder Loan

Some banks and NBFCs offer credit builder loans that help improve your score. repay the loan on time to boost your score. choose a short-term loan to build credit quickly.

How long Does it take to Improve CIBIL Score?

Improving your CIBIL score form 500 to 750 takes 6-12 months, depending on your financial discipline. If you follow these tips, you can see significant improvement within a year.

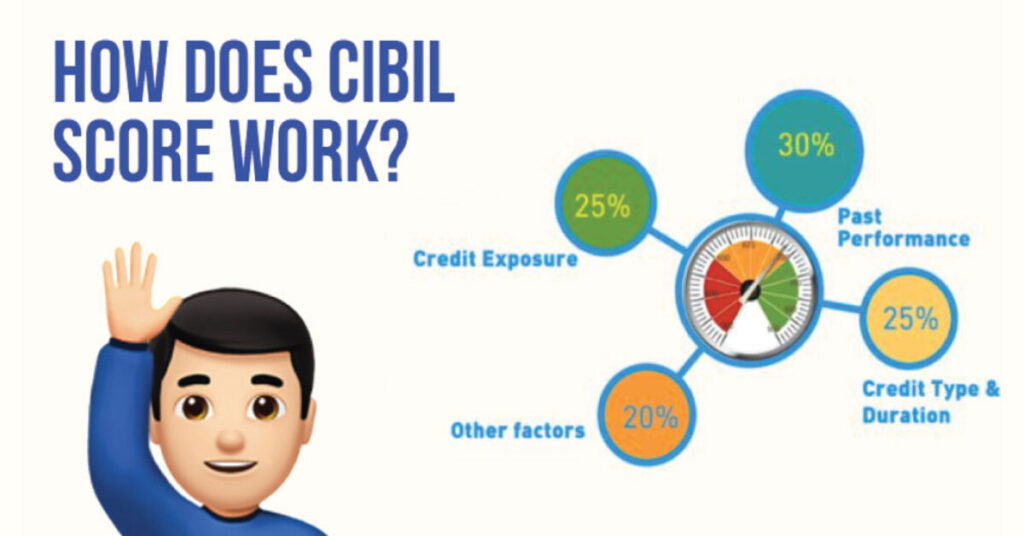

How Does the CIBIL Score Work?

The CIBIL score is determined based on the information in an individual’s credit report, which reflects their credit history. Several factors influence this score, including the types of credit accounts they hold (such as credit cards and loans), payment history, outstanding debt, and credit utilization ratio.

Key Factors Affecting Your CIBIL Score

Payment History

Your repayment behavior plays a crucial role in determining your CIBIL score. Consistently paying off credit dues on time signals responsible credit management, which helps improve your score. On the other hand, late payments, defaults, and loan settlements can significantly reduce it.

Credit Utilization Ratio

This refers to the percentage of your credit limit that you are using. A high credit utilization ratio may indicate over-reliance on credit, which can negatively impact your score. Ideally, keeping your credit utilization below 30% is recommended for a healthy score.

Credit Mix & Credit History

A balanced mix of secured (like home or car loans) and unsecured credit (such as credit cards) can positively impact your score. Additionally, a longer credit history—with a track record of responsible credit usage—helps build a strong CIBIL score.

Credit Enquiries

Every time you apply for a new loan or credit card, a hard inquiry is made by the lender, which can temporarily lower your CIBIL score. Applying for multiple loans or credit cards within a short period can negatively affect your creditworthiness.

Public Records

Negative financial records, such as bankruptcies or tax liens, can significantly damage your CIBIL score and make it harder to secure credit in the future.

How to Improve Your CIBIL Score?

To enhance your CIBIL score, focus on:

Paying all EMIs and credit card bills on time.

Keeping your credit utilization ratio below 30%.

Maintaining a balanced mix of secured and unsecured credit.

Avoiding multiple loan applications in a short time.

Regularly checking your credit report for errors and correcting discrepancies.

By understanding these factors and managing your finances wisely, you can steadily improve your CIBIL score and enhance your creditworthiness.

Conclusion

Boosting your CIBIL score from 500 to 750 is possible by paying bills on time, reducing credit usage, avoiding unnecessary loan applications, and maintaining a long credit history. With consistent efforts, your credit score can improve within 6-12 months. Start today and take control of your financial future!

If You Have Any Further Questions. So We Will Answer Your Questions By Commenting. If You Liked This Article, Share Your Suggestions And Feedback In The Comments. Apart From This, You Can Read My Blog at Dsrtalkies.com. And Want To Get Information About The Mobile, Laptop, Watch, And Airpods. So If You Are Thinking Of Buying This Then Click On Dsrtalkies.com ! Thank You…

FAQs (Frequently Asked Questions)

You can increase your CIBIL score online by:

Paying your bills on time.

Reducing your credit utilization below 30%.

Regularly checking and correcting errors in your CIBIL report.

Opting for a secured credit card or loan.

Maintaining a long credit history.

To improve your credit score from 550 to 750, follow these steps:

Make timely EMI and credit card payments.

Keep credit utilization low (below 30%).

Avoid applying for multiple loans in a short time.

Check and correct errors in your credit report.

Use a secured credit card or credit-builder loan.

To increase your score from 500 to 700, you should:

Ensure all EMIs and bills are paid on time.

Lower your credit usage and request a credit limit increase.

Stop applying for multiple loans at once.

Check your credit report regularly and dispute any mistakes.

Opt for secured credit options to build a positive history.

No, 400 is a very low CIBIL score. With this score, getting a loan or credit card approval is extremely difficult. You may need to improve your financial habits significantly before applying for any credit.